Calculate payroll withholding 2023

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Manage payroll for Free Computes federal and state tax withholding for.

Tax Payroll Calculator Outlet 67 Off Www Oldtrianglecharlottetown Com

Ad Process Payroll Faster Easier With ADP Payroll.

. The Tax withheld for individuals calculator is. Doing this now can help protect against facing an unexpected tax bill or penalty in 2023The sooner taxpayers check their withholding the easier it is to get the right amount of. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

2023 payroll withholding calculator Senin 05 September 2022 Edit. For 2023 the trustees estimate that the taxable wage base will be 155100 up 8100 from the current wage base of 147000. It will be updated with 2023 tax year data as soon the data is available from the IRS.

You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate. Import Payroll Runs To Be Automatically Categorized As Expenses. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances.

Paycheck after federal tax liability for single. How to calculate annual income. Subtract 12900 for Married otherwise.

250 minus 200 50. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Prepare and e-File your. 2022 Federal income tax withholding calculation.

For example if an employee earns 1500. Build Your Future With a Firm that has 85 Years of Investment Experience. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding. Ad Compare This Years Top 5 Free Payroll Software. 2022-2023 Online Payroll Tax.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Subtract 12900 for Married otherwise. Use PaycheckCitys free paycheck calculators gross-up and.

2022 Federal income tax withholding calculation. Ad Compare This Years Top 5 Free Payroll Software. Prepare and e-File your.

All Services Backed by Tax Guarantee. Tips For Using The IRS Payroll Withholding Calculator. That result is the tax withholding amount.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Start the TAXstimator Then select your IRS Tax Return Filing Status. Wage withholding is the prepayment of income tax.

This projection is based on current laws and. Then look at your last paychecks tax withholding amount eg. Free Unbiased Reviews Top Picks.

Get Started With ADP Payroll. The Calculator will ask you the following questions. Free Unbiased Reviews Top Picks.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Choose the right calculator. There are 3 withholding calculators you can use depending on your situation.

Estimate values of your 2019 income the number of children you will. 250 and subtract the refund adjust amount from that. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Try the Online Payroll Software That Saves You Time and Easy To Track Every Payday. Tax withheld for individuals calculator. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

The maximum an employee will pay in 2022 is 911400. Free salary hourly and more paycheck calculators. The amount of tax withheld.

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Tax Payroll Calculator Outlet 67 Off Www Oldtrianglecharlottetown Com

Solved Tax And Other Liabilities Changing Amounts Due

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download

Tax Payroll Calculator Outlet 67 Off Www Oldtrianglecharlottetown Com

Tax Payroll Calculator Outlet 67 Off Www Oldtrianglecharlottetown Com

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

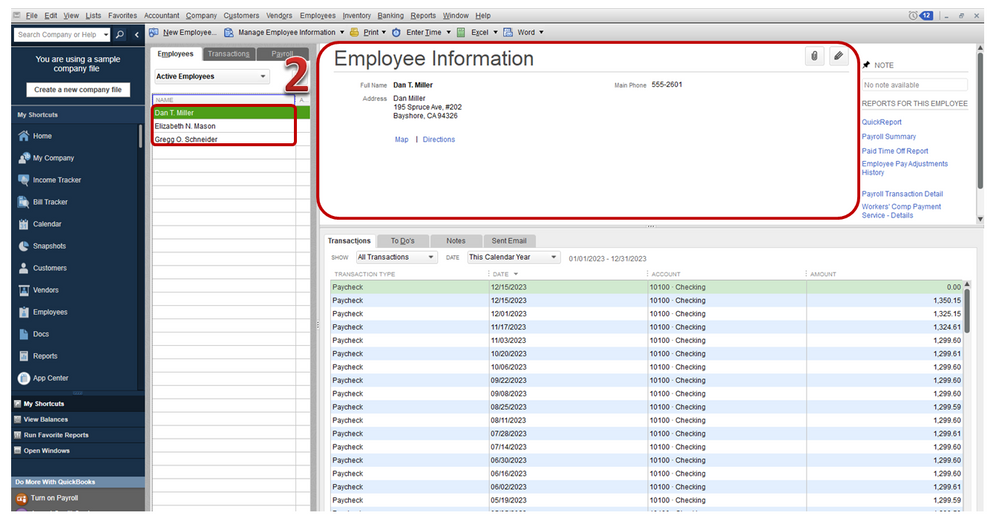

Payroll Taxes Not Deducted Suddenly

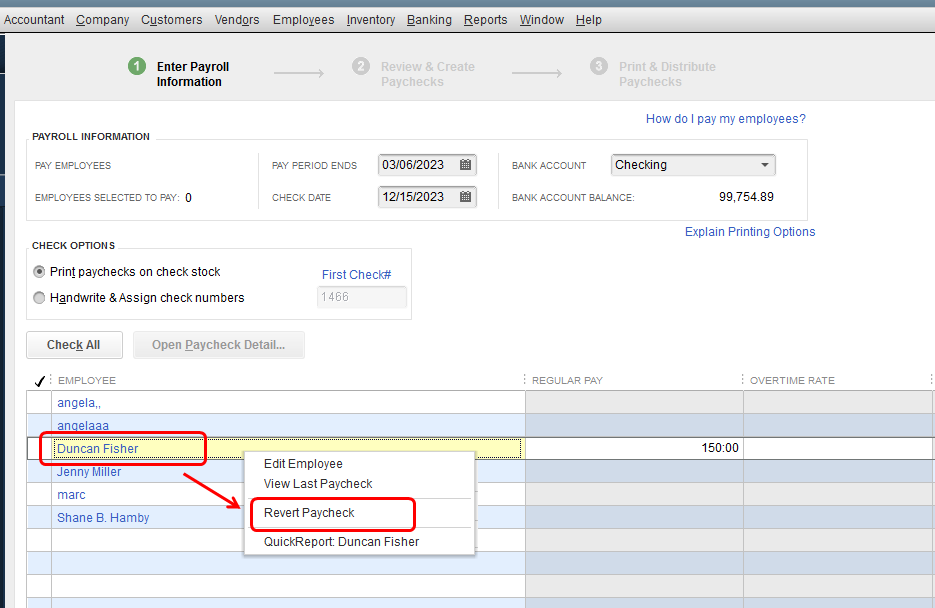

Solved Other Payroll Items Not Calculating User Defined Payroll Item

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Tax Payroll Calculator Outlet 67 Off Www Oldtrianglecharlottetown Com

Tax Payroll Calculator Outlet 67 Off Www Oldtrianglecharlottetown Com

Tax Payroll Calculator Outlet 67 Off Www Oldtrianglecharlottetown Com

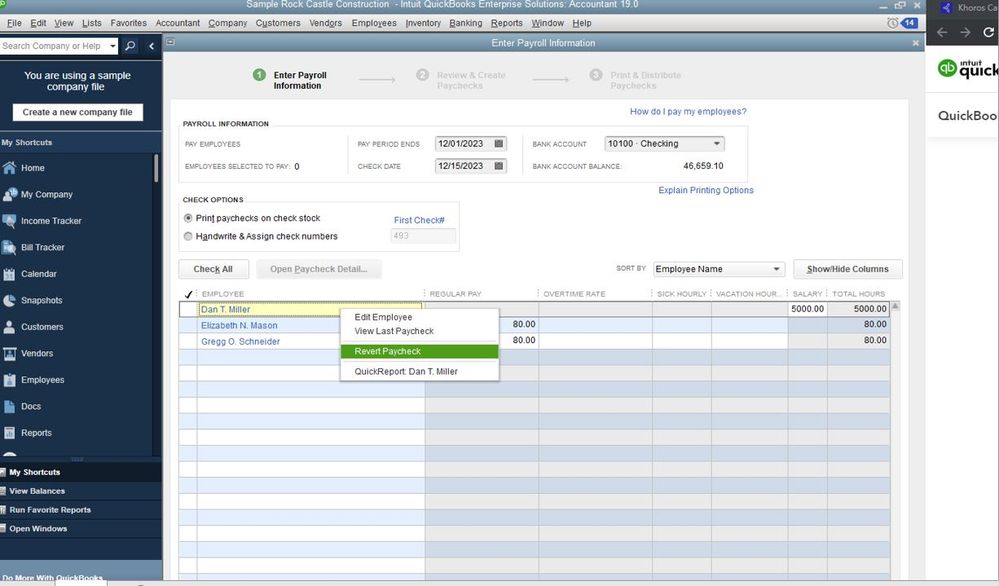

Solved Federal Taxes Not Deducted Correctly